Lessons from Warren Buffett: Berkshire Hathaway AGM

Berkshire Hathaway is my favourite “hare and the tortoise” company to own, and to keep owning. Founded and still run by investment legend Warren Buffett, it is in their DNA to be defensive investors.

The share price is up 27% in the last year and they recently held their annual general meeting in Omaha in a large concert venue. The event is known as Woodstock for Capitalists.

Here are some bullet point notes from the 2 day event.

1. Q1 was good for Berkshire Hathaway. The company keeps compounding at attractive rates

2. Berkshire earns more than $100 million per day currently

3. Coca Cola and American express will probably never be sold

4. Apple will (probably) remain the largest position of Berkshire Hathaway in the years to come

5. Berkshire Hathaway will keep buying back shares in the years to come

6. Berkshire Hathaway‘s primary investments will always be in the United States

7. Buffett feels extremely good about his exposure to Japan

8. Insurance is the most important business for Berkshire Hathaway

9. Geico (insurance company owned 100% by Berkshire Hathaway) has lower costs than virtually any insurance company

10. Geico is still an amazing business. The company is making progress in its data analytics

11. Insurance is still an excellent business. Ajit is doing an amazing job

12. The best time to sell a wonderful company is (almost) never

13. Higher taxes are quite likely in the future according to Buffet

14. The market is there to serve you. Use it to your advantage

15. The power of compounding is the most underrated power in the world

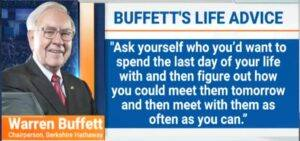

16. Don’t try to time the market

17. Don’t check stock prices daily

18. Always look at a stock like a business

19. Always surround yourself with people you look up to and trust

20. Hire for integrity, intellect, and hard work. Skills can be taught

21. Big tribute to Charlie Munger, Buffett’s Investment Partner who died this year at the age of 99.

22. “During our entire partnership, Charlie never lied to me even once.”

23. “Charlie was the best Partner I could have very imagined.”

24. “Charlie’s two best ideas were probably BYD and Costco”

.

And finally some sage advice from Buffett who clearly misses his buddy Charlie